Personal Income Tax for YA2012 Finance Malaysia hopes this article doesnt come late to give you some info on Personal Income Tax filling for year of assessment 2012. See Taxable Income of Non-Resident Professionals c Income derived from activity as a non-resident public entertainer artiste musician sportsman etc 10 concessionary rate No change.

Why Are Singapore S Taxes So High Most Of Which Being Indirect Taxes Or Hidden Quora

Maybe due to the general election which had diverts our attention lately.

Personal income tax for ya2012. So FM would like to use back the same table posted last year here. Any amount paid to Non-Resident individuals in respect of any employment with or services rendered to an employer who is resident in Kenya or to a permanent establishment in Kenya is subject to income tax charged at the prevailing individual income tax rates. Nonresidents are subject to withholding taxes on certain types of income.

Personal Income Tax Act. Other income is taxed at a rate of 30. Individuals are taxed based on the income earned in the preceding calendar year.

Personal Income Tax for YA2012 Finance Malaysia hopes this article doesnt come late to give you some info on Personal Income Tax filling for year of assessment 2012. Personal Income Tax for YA2011 Many readers asking us why we did not update the Personal Income Tax Relief for year of assessment 2011 and below the table explain why. 1 A medical policy must satisfy the following criteria.

Nothing special because the tax relief for YA2011 was the same as previous year 2010. Private Retirement Scheme PRS is the NEW item which can help you reduce tax further with additional RM3000 tax relief from YA2012-YA2021. Based on the Talentcorps Web site which is the authority handling the Returning Expert Programme the approved individual could opt to be taxed under the scale rates instead of 15 percent.

So FM would like to use back the same table posted last year here. The personal income tax relief is currently applicable from YA2012 to YA2021. Nothing special because the tax relief for YA2011 was the same as previous year 2010.

To qualify for the this income tax relief the Malaysian insurance policy must be in your name policy owner as the claimant. Education and medical insurance INCLUDING not through salary deduction 3000. So FM would like to use back the same table posted last year here.

Nothing special because the tax relief for YA2011 was the same as previous year 2010. Maybe due to the general election which had diverts our attention lately. Personal Income Tax for YA2012 Finance Malaysia hopes this article doesnt come late to give you some info on Personal Income Tax filling for year of assessment 2012.

As such Item No22 would be replaced until after YA2021. Maybe due to the general election which had diverts our attention lately. YA2012 to YA2021.

Personal Income tax is payable on the taxable income of residents at the progressive rates from 0 to 30 with effective Year of Assessment 2020. Anyway do remember to file your income tax before 30th April oh. Residents and non-residents are subject to tax on Malaysian-source income only.

All individuals earning deriving or receiving income in Singapore need to pay income tax every year unless specifically exempted under the Income Tax Act or by an Administrative Concession. Maybe due to the general election which had diverts our attention lately. Year of assement 2012 1-1-2012 to 31-12-2012.

Used to confused by the YA2012 term. Personal Income Tax for YA2012 Finance Malaysia hopes this article doesnt come late to give you some info on Personal Income Tax filling for year of assessment 2012. Many readers asking us why we did not update the Personal Income Tax Relief for year of assessment 2011 and below the table explain why.

Effective from YA2012 the employment income of an approved individual under the Returning Expert Programme will be taxed at the rate of 15 percent. Income derived from activity as a non-resident professional consultant trainer coach etc 15 of gross income or 22 of net income. Personal income tax relief of RM3000 for PRS contributions and Deferred annuity scheme premium extended for another 4 years.

Taxation for Non- Residents Employment Income. Personal Income Tax for YA2011 Many readers asking us why we did not update the Personal Income Tax Relief for year of assessment 2011 and below the table explain why. Maybe due to the general election which had diverts our attention lately.

28800 per annum Kshs. Personal Income Tax for YA2012 Finance Malaysia hopes this article doesnt come late to give you some info on Personal Income Tax filling for year of assessment 2012. Chargeable income of that individual is less than 05 per cent of the total income of that individual the individual shall be charged to tax at the rate of 05 per cent of his total income.

Personal Relief of Kshs. Maybe due to the general election which had diverts our attention lately. Personal Income Tax for YA2012 Finance Malaysia hopes this article doesnt come late to give you some info on Personal Income Tax filling for year of assessment 2012.

Tax Relief for Resident Individual Year 2012 YA2012 From 1st Jan 2012-31st Dec 2012.

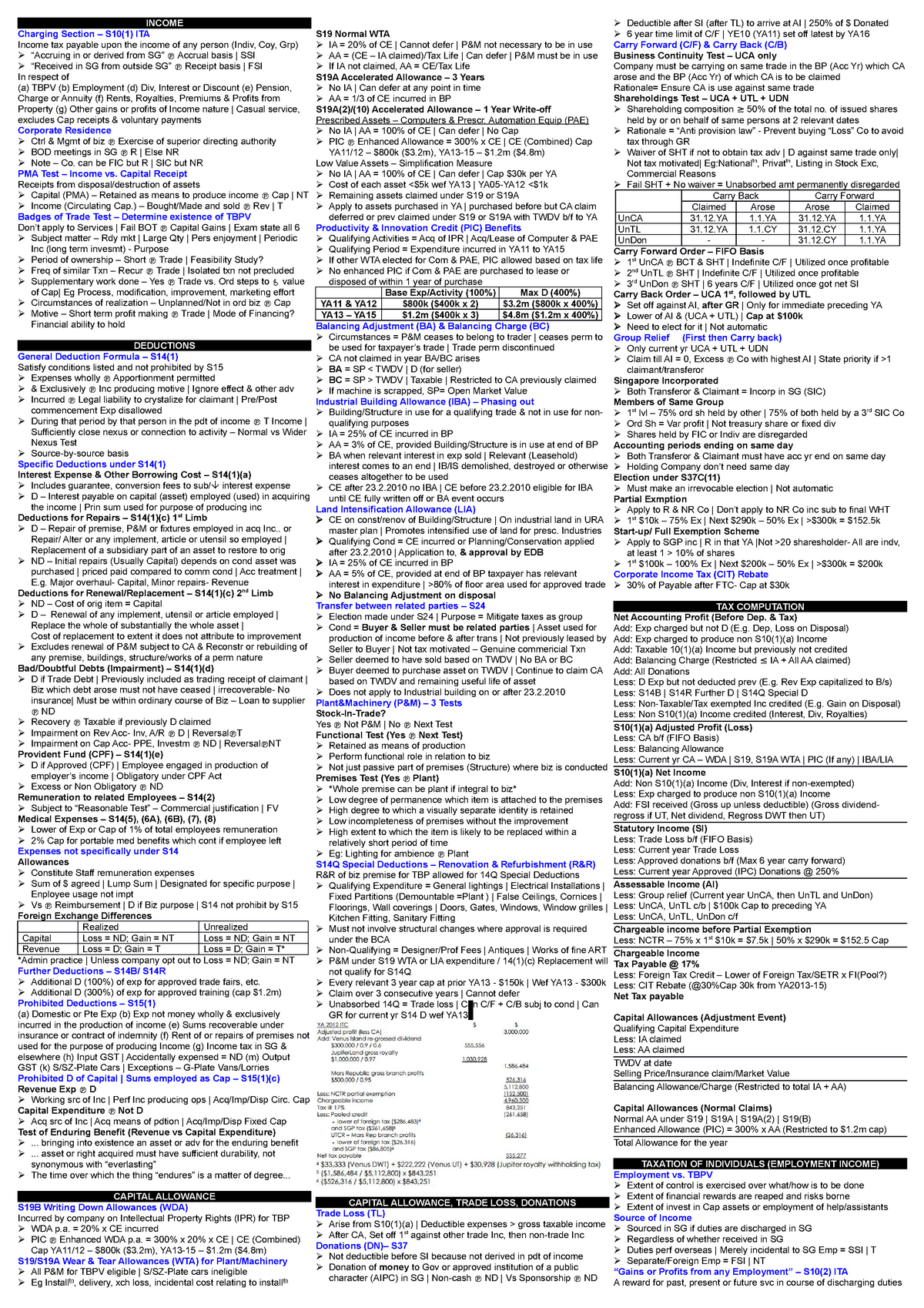

Tax Administration Of Self Assessment System Ppt Video Online Download

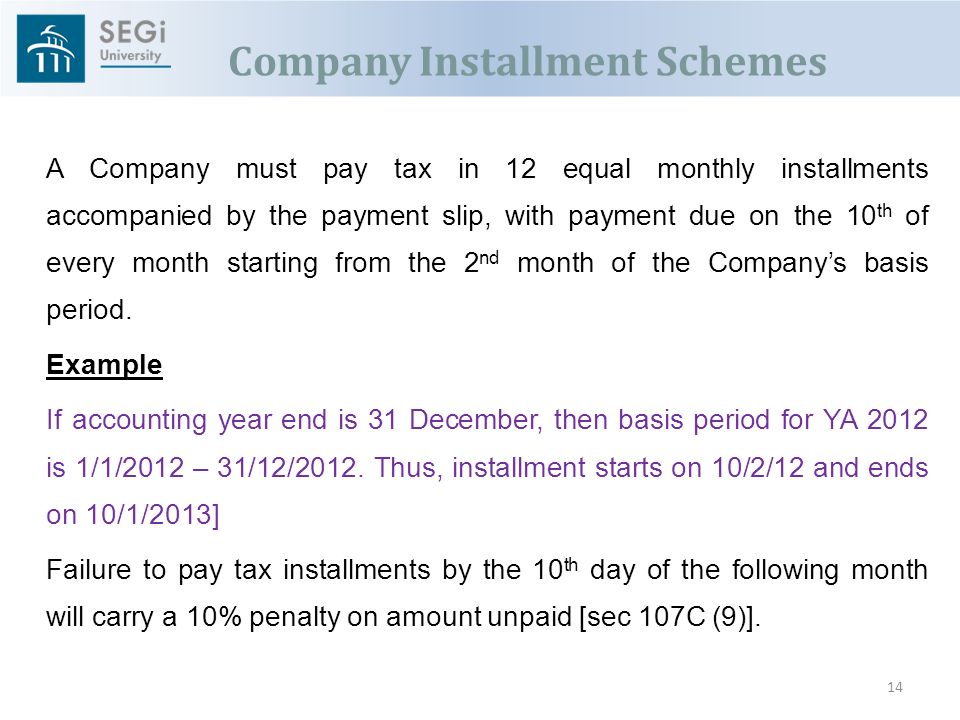

Basis Periods By Associate Professor Dr Gholamreza Zandi Ppt Download

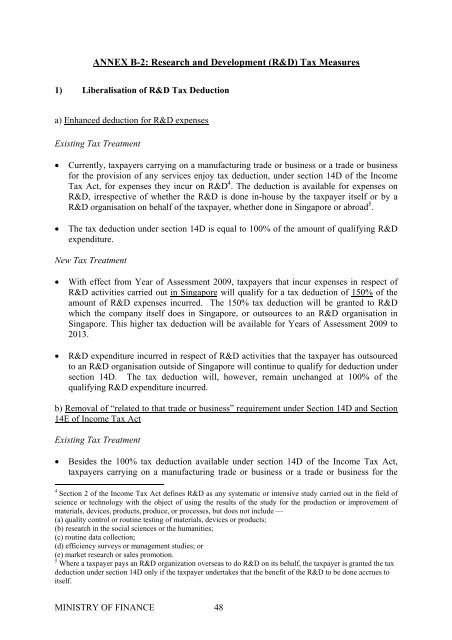

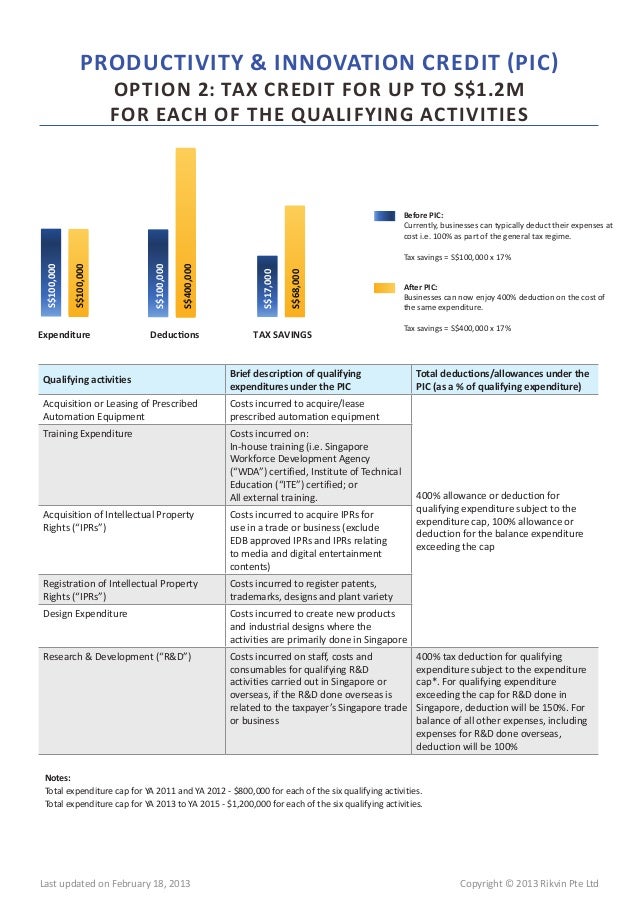

Annex B 2 Research And Development R D Tax Measures

Basis Periods By Associate Professor Dr Gholamreza Zandi Ppt Download

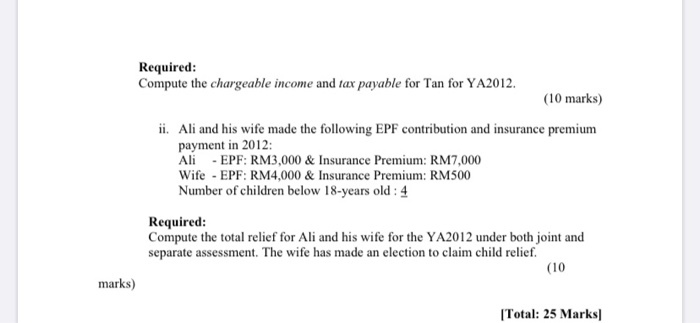

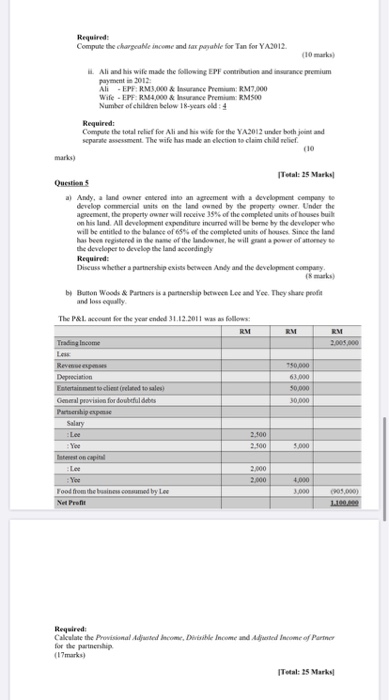

Section A Practical Questions Total 100 Marks Chegg Com

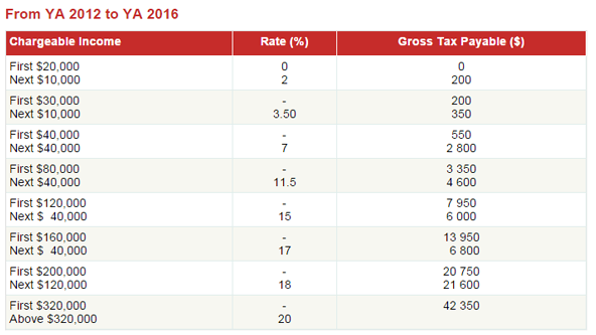

What Is The Income Tax Rate For Salaried Professionals In Singapore Quora

Zakat And Tax Treatment Hj Musa Bin Othman Honorary Secretary Malaysian Association Of Tax Accountants M A T A Pdf Free Download

Singapore Corporate Tax Rates 2013

Foundations In Taxation Pdf Free Download

5 April 2012 Dear Sir Mdm Simplified Income Tax Filing For Small

Ktps Consulting Personal Reliefs It S Time To File Your Facebook

Question 3 5 Needs Help To Be Answeredquestion Chegg Com

What Is The Income Tax Slab In Singapore Quora

Singapore Personal Income Tax Guide Tassure Asia Group

Ktps Consulting Personal Reliefs It S Time To File Your Facebook

How To Get Your Prs Tax Relief Statement From Ppa April 2013