The rule amends withholding tables and other methods applicable to wages and other compensation paid on or after September 1 2010. The City of Baltimore increased its income tax from 305 to 32 effective January 1 2011.

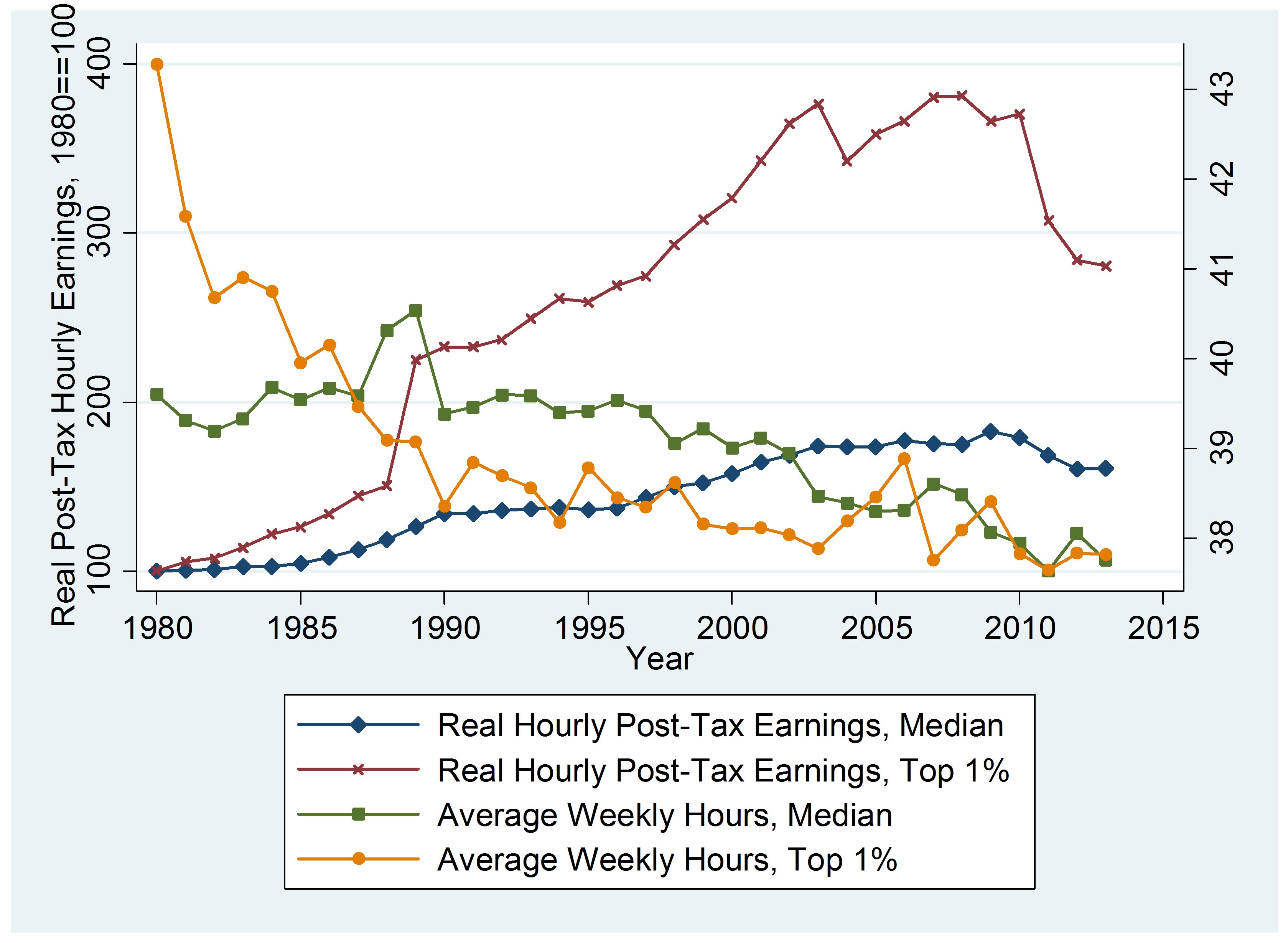

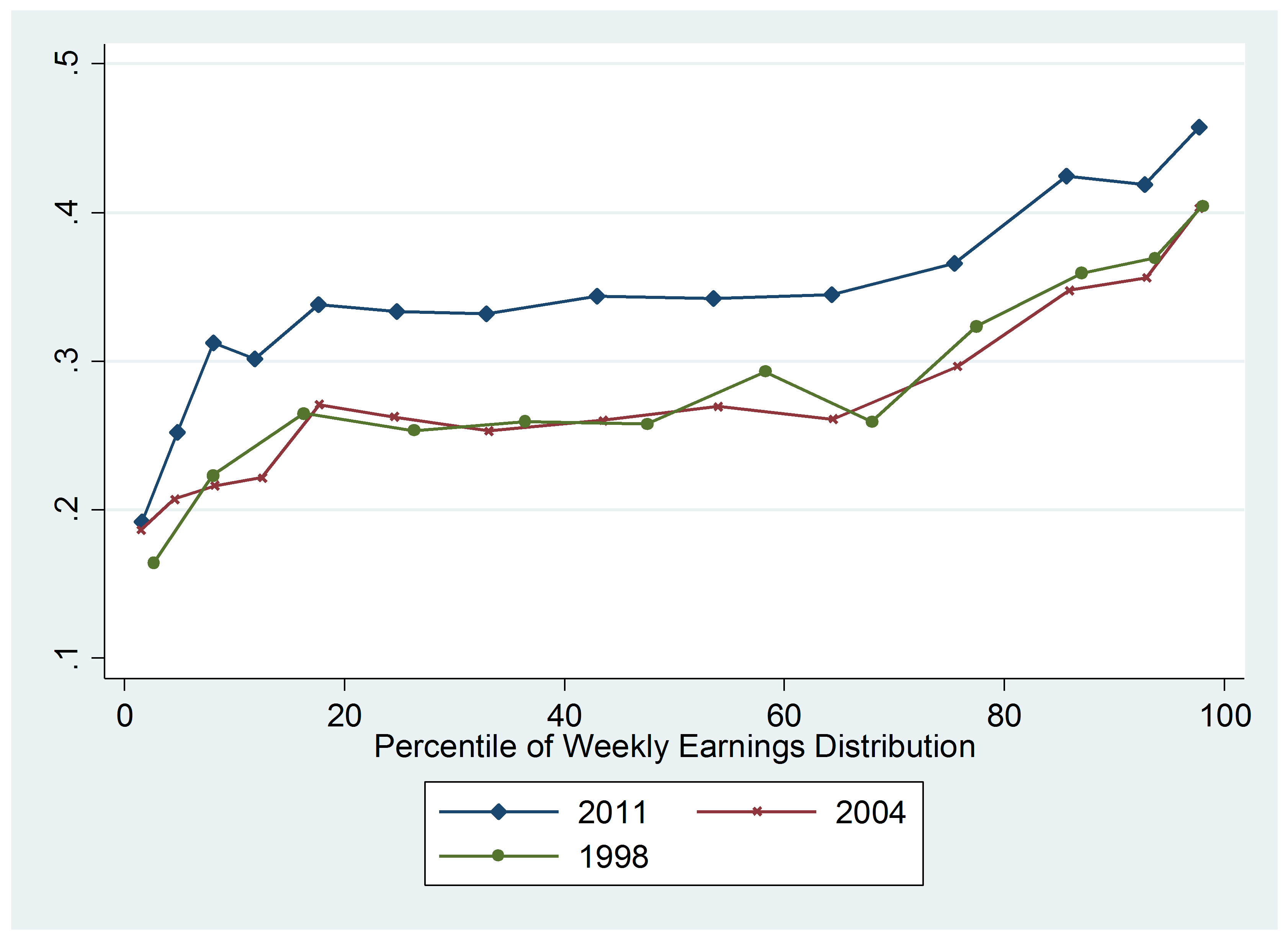

Personal Income Tax Progressivity Trends And Implications In Imf Working Papers Volume 2018 Issue 246 2018

591 percent of total income tax for 2010.

Personal income tax 2010. Round by eliminating any amount less than 050 and increasing any amount that is 050 or more to the next highest dollar. 2010 Pennsylvania TeleFile Worksheet 1-888-4PAFILE 1-888-472-3453 Number of Forms W-2 If more than 7 youcannot use TeleFile. Information from each Form W-2 Wage and Tax Statement Enter amounts in whole dollars.

She would pay federal income tax of 468125 plus 25 on her income over 34000. The defined aggregate income of the year of assessment 2009. Chargeable income of that individual is less than 05 per cent of the total income of that individual the individual shall be charged to tax at the rate of 05 per cent of his total income.

It provides information on taxable income by income categories age gender and source of income as well as on fringe benefits allowances and other deductions. Emergency Adoption and Proposal to amend Appendix 10-C of Title 20 NYCRR to adjust the New York City income tax withholding tables and methods in accordance with Part EE of Chapter 57 of the Laws of 2010. The basic and higher income tax rates remain at 20 and 40 for 200910 and 20102011.

DFO-02 -- Personal Individual Tax Preparation Guide for Personal Income Tax Returns PA-40. Marylands top income tax rate of 625 on income over 1 million expired as planned on December 31 2010. The personal allowance will be increased to 10500 in 2015 to 2016.

Conditions for claiming carry-back loss under section 44B of ITA 1967- z The amount of adjusted loss for the basis period for the year of assessment 2010 allowed for carry-back- i shall not exceed RM100000. DEX 93 -- Personal Income Tax Correspondence Sheet. 201011 255000 1800000 55 Basic amount qualifying for tax relief 3600 Notes 1 Individuals with incomes above 130000 excluding employer pension contributions may be subject to a Special Annual Allowance which restricts tax relief on their pension contributions in excess of normal patterns to basic rate relief.

117 rader General Information for Senior Citizens and Retired Persons - For tax year 2010. OECDs dissemination platform for all published content - books serials and statistics. The number of taxpayers choosing to file their return electronically in 2010 grew 139 percent to 134 million.

Martin OMalley D opposes the extension of the tax. PA-1 -- Online Use Tax Return. This article discusses the individual income tax rates and tax shares and the computation of total income tax for 2010.

From 2010 incomes above 150000 will be subject to a new 50 income tax rate. Or ii where the defined aggregate income is less than RM100000. From 2010 the personal allowance will be tapered to zero for those with incomes over 100000.

PA-19 -- PA Schedule 19 - Sale of a Principal Residence. Residential Property With effective from Year of Assessment YA 2009 Malaysian resident who acquired any residential property are given the specially designed tax relief of up to RM10000 a year for 3 consecutive years from the first year the interest is paid. The average tax liability for all filers was 2790 in 2010 up 60 percent from 2663 in 2009.

Personal Income Tax 2010. Delaware Non-Resident Individual Income Tax Return Instructions for Form 200-02 Download Fill-In Form 181K 2010 Income Tax Table Download Fill-In Form 53K 200 V Payment Voucher Download Fill-In Form 90K Schedule W Apportionment Worksheet Download Fill-In Form 127K 200-01X Resident Amended Income Tax Return Download Fill-In Form 274K. The 468125 covers taxes calculated on income that falls in the 10 and 15 brackets.

For example a single person earning 50000 would be in the 25 tax bracket in 2010. PARAMETERS OF THE PERSONAL INCOME TAX SYSTEM FOR 2010 Fall 2009 Legal deposit - Bibliothque et Archives nationales du Qubec December 2009 ISBN 978-2-550-57799-7 PDF. To be included in the top 5 percent a tax return must have had AGI of at least 161579 whereas in 2009 the cutoff for this group was 157342.

2010 Personal Income Tax Forms. Personal Income Tax Act. By April 2015 32 million low-income people will have been lifted out of paying income tax altogether.

The 2010 total tax liability for all filers was 50 billion up 74 percent from 47 billion in 2009. Personal income tax PIT gives an overview of assessed personal income tax revenues of registered individual taxpayers. The tax had been enacted on a temporary basis in 2008.

The 25 amount covers taxes calculated on income only within the 25 bracket.

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Income Taxation In Germany Gofrankfurttax

Archive Tax Revenue Statistics Government Revenue From Taxes And Social Contributions Statistics Explained

Tax Revenue Statistics Statistics Explained

Tax Revenue Statistics Statistics Explained

Personal Income Tax Progressivity Trends And Implications In Imf Working Papers Volume 2018 Issue 246 2018

The Top Rate Of Income Tax British Politics And Policy At Lse

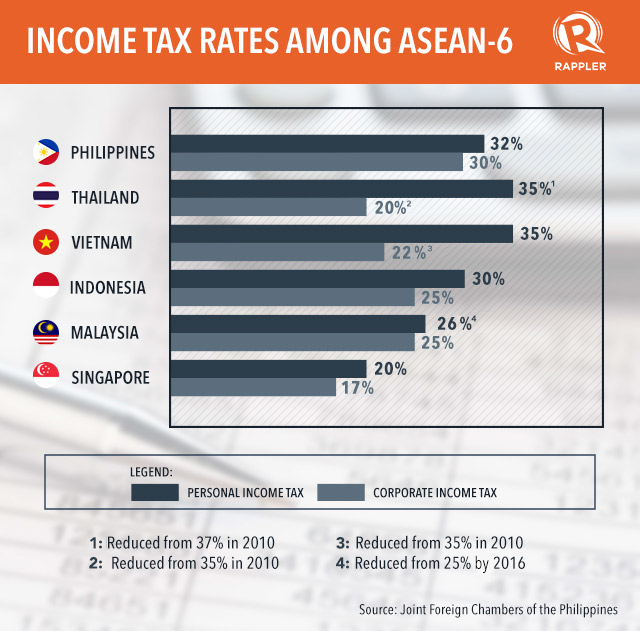

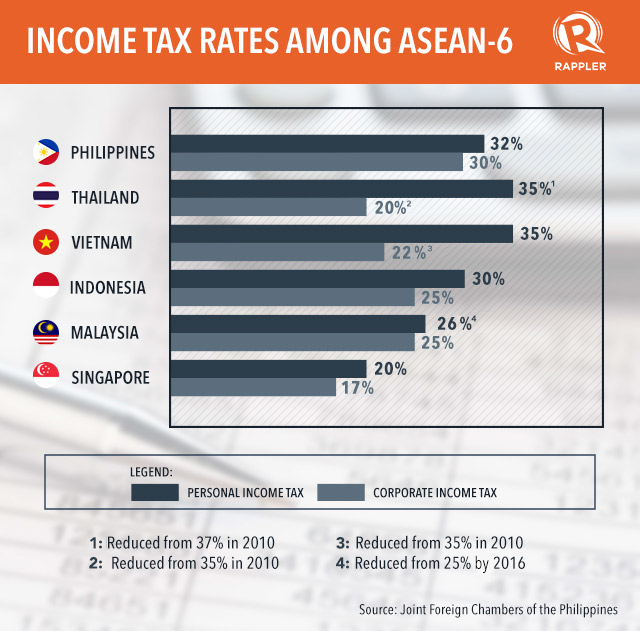

Why Ph Has 2nd Highest Income Tax In Asean

Tax Revenue Statistics Statistics Explained

The Top Rate Of Income Tax British Politics And Policy At Lse

Tax Revenue Statistics Statistics Explained

2 Australia S Tax System Treasury Gov Au

Interaction Of Household Income Consumption And Wealth Statistics On Taxation Statistics Explained

Tax Revenue Statistics Statistics Explained

Personal Income Tax Progressivity Trends And Implications In Imf Working Papers Volume 2018 Issue 246 2018

Personal Income Tax Progressivity Trends And Implications In Imf Working Papers Volume 2018 Issue 246 2018

Personal Income Tax An Overview Sciencedirect Topics

France S Weak Economic Performance Sick Of Taxation Vox Cepr Policy Portal