I 469000000 OFFER UNITS MADE AVAILABLE FOR APPLICATION BY MALAYSIAN AND FOREIGN INSTITUTIONAL INVESTOR AND SELECTED INVESTORS AT THE INSTITUTIONAL PRICE BEING THE PRICE PER OFFER UNIT TO BE PAID BY THE INVESTORS WHICH WILL BE DETERMINED. The group said in a statement it had introduced digital and cashless alternatives for application and acceptance in addition.

Igb Commercial Reit Ipo 8 Things You Need To Know Kaya Plus

However this does not deter us from conducting due diligence based on the earlier draft of the prospectus in terms of IGB REITs strength weakness opportunities and threats.

New ipo igb reit. IGB Commercial Real Estate Investment Trust IGB Commercial REIT has postponed its planned initial public offering IPO after extending the closing date for the restricted offering to Aug 20 from July 6. IGB Commercial REIT is not raising any amount from the IPO as there is no issuance of new units but IGB will receive about RM287 billion from. Upon listing IGB Commercial REIT is expected to have a market capitalisation of RM231 billion based on the price of the ROFS units at RM1 each making it the sixth largest REIT on the local bourse.

IGB Commercial Real Estate Investment Trust IGB Commercial REIT said today its initial public offering IPO will involve the listing of 231 billion units on Bursa Malaysias Main Market under a corporate exercise which comprises a restricted offering of up to 945 million units and an institutional offering of at least 282 million units in. Although IGB remains tight-lipped on the schedule for the planned initial public offering IPO sources say it could be as early as November. Yes the plans are still on for IGBs planned commercial REIT listing and would include the same list of assets announced to Bursa Malaysia in November IGBs head of group strategy and risk Tan Mei Sian tells The Edge without providing.

IGB Bhd announced today that its proposed commercial real estate investment trust REIT will be established by the end of this year with the group set to raise up to RM123 billion through the disposal of 10 properties to the trust. Malaysian Issuing House Sdn Bhd announce that the initial public offering IPO of IGB Reit under which 34 million offer units were made available for application by the Malaysian public has been oversubscribed. Yes the plans are still on for IGBs planned commercial REIT listing and would include the same list of assets announced to Bursa Malaysia in November IGBs head of group strategy and risk Tan Mei Sian tells The Edge without providing.

Initial public offering of 670000000 new units in igb reit offer units comprising an offer for sale of. KUALA LUMPUR July 2. At the mid-point of the IPO price range the net proceeds are 37954 million below the rumoured 10 billion raise target.

IGB Commercial REIT offers digital and cashless alternatives for application. Didi has received 1250 million indications of interest 322 of the ADSs being offered from Morgan Stanley Investment Management 750 million and Temasek 500 million. KUALA LUMPUR June 11.

June 11 2020 2225 pm 08. IGB Commercial REIT will IPO at RM1 per unit. KUALA LUMPUR June 10.

IGB Bhd said today shareholders can now subscribe to IGB Commercial REITs units via electronic means in view of the resurgence of the Covid-19 pandemic. June 10 2021 1039 am 08. IGB REIT IPO retail offering has been delayed from its original date of 23 August 2012 pending Securities Commission final approval on its prospectus.

IGB Commercial Real Estate Investment Trust IGB Commercial REIT said today its initial public offering IPO. The offering of IGB Reit involves the issuance of. The group said the IGB Commercial REIT comprising 231 billion units will be listed on the Main.

Hence to raise RM 231 billion there will be the same amount of listing shares on Bursa Malaysia. The new REIT will focus on buying warehouses leased to e-commerce giant Amazon NasdaqAMZN. KUALA LUMPUR June 10.

Although IGB remains tight-lipped on the schedule for the planned initial public offering IPO sources say it could be as early as November. Meanwhile the REITs tentative listing date has been pushed to Sept 20 from July 30. Although IGB remains tight-lipped on the schedule for the planned initial public offering IPO sources say it could be as early as November.

IGB Commercial REIT is planning to push ahead with a delayed initial public offering in Malaysia next month part of its efforts to spin off from its parent company to focus on office properties. Out of the total 231 billion units 945 million units will be categorized as Restricted Offering to existing IGB Berhad shareholders. - A A.

Rox Financial LP has filed for an IPO to raise. - A A. IGB Commercial Real Estate Investment Trust IGB Commercial REIT will see the listing of 23 billion units on Bursa Malaysias Main Market via.

KUALA LUMPUR June 21. Yes the plans are still on for IGBs planned commercial REIT listing and would include the same list of assets announced to Bursa Malaysia in November IGBs head of group strategy and risk Tan Mei Sian tells The Edge without providing. The group said the IGB Commercial REIT comprising 231 billion units will be listed on the Main Market of Bursa Malaysia after an initial public offer IPO.

In a filing with the exchange IGB said the management is currently evaluating the options for the optimal use of the proceeds which may include potential investments or repayment of borrowings.

8 Things I Learned From The 2021 Igb Reit Agm

Igb Commercial Reit Delays Ipo Listing Cuts Size Of Institutional Offering The Edge Markets

Igb Commercial Reit Buys 10 Properties From Igb Group For Rm3 16bil The Star

6 Things We Learned From The 2018 Igb Reit Agm

Igb Commercial Reit To Be The Largest Standalone Office Reit By Net Lettable Area When It List Next Month

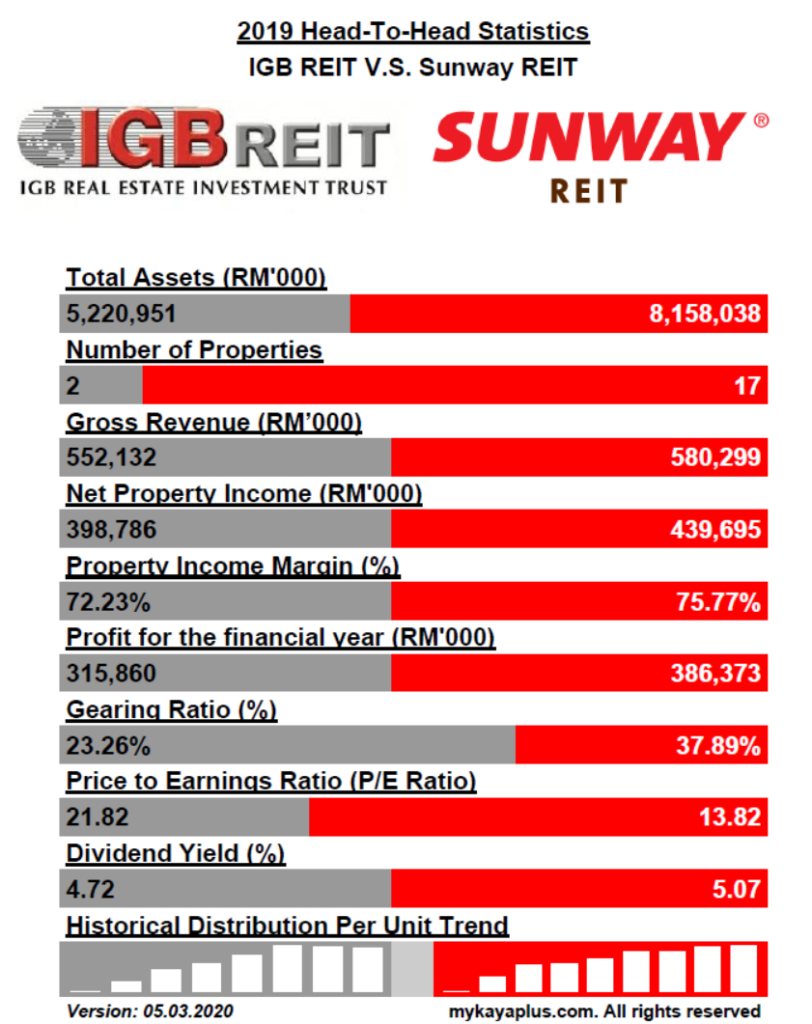

Igb Reit V S Sunway Reit Kaya Plus

How To Invest In Malaysia Reits Best Guide For Beginner Ringgit Insider

Financial Management Solutions Fortune My Investing Reit Financial Management

Igb Commercial Reit Opens Ipo Application Says Bursa Listing On July 30

Key Things You Must Know About Igb Real Estate Investment Trust Before Investing

Igb Reit 2q Net Profit Down 75

Financial Management Solutions Fortune My Investing Reit Financial Management

Igb Commercial Reit To Have Market Cap Of Rm2 3b On Listing The Star

Igb Commercial Reit Opens Ipo Applications

Igb Commercial Reit Ipo 8 Things You Need To Know Kaya Plus