Conveyed or set off fear. The central bank completely controls and.

Fed Signals No Rate Rise Until At Least 2024 Despite Growth Upgrade Financial Times

The Federal Reserve has a dual mandate from Congress to maintain full employment and prices stability in the US.

Why so fear if us federal reserve stop. The Bankers own the earth. Historical Changes of the Target Federal Funds and Discount Rates 1971 to Present Page 2. To help accomplish this during recessions the Fed employs various.

Danielle DiMartino Booth author of Fed Up. The Fed has embarked on a massive expansionary quest in recent years. The Fed tries to influence the supply of money in the economy to promote noninflationary growth.

Board of Governors of the Federal Reserve System. Unless there is an increase in economic activity commensurate with the amount of money that is created printing money to pay off the debt would make inflation worse. Trumps trade tariffs led to losses in billions.

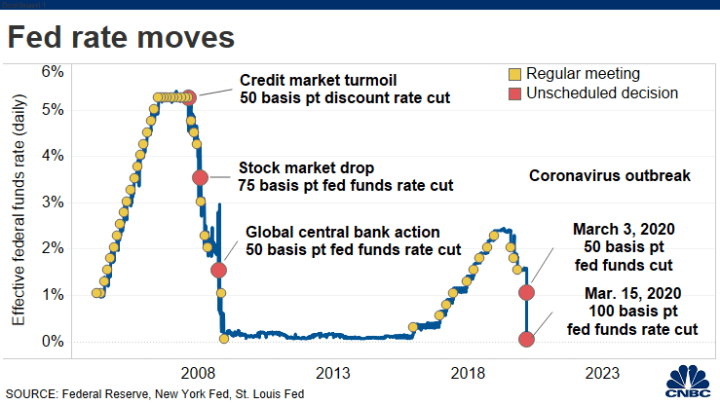

Following that panic a national monetary system was created to study the financial. Fears grew that the US Federal Reserve would tighten policy too quickly and this would cause a sharp rise in interest rates to bring down risk assets and stock markets. This would be as the saying goes too much money chasing too few goods.

Changes in the federal funds rate influence other interest rates that in turn influence borrowing costs for households and businesses as well as broader financial conditions. Federal Reserve History. The Federal Reserve System is a government-sanctioned private enterprise that functions as a socialist tool.

No Federal Reserve System in Washington. Federal Reserve Chairman Ben Bernanke has the power to dramatically impact our economy at a drop of the hat. A popular account of that period attributes the stock market boom to easy credit and rising speculation.

The Federal Reserves Response to the Financial Crisis and Actions to. Justin Sullivan Getty Images One of the main reasons Federal Reserve officials dont fear inflation these days is the belief that they have tools to deploy should it become a problem. Why was the Fed unable to stop that economic disaster from happening.

The period ended with panic selling on Wall Street and triggered the beginning of the Great Depression. That was roughly three times the extraordinary growth in the consolidated balance sheet for the Reserve Banks in the 2008-2009 financial crisis. The primary tool the Federal Reserve uses to conduct monetary policy is the federal funds ratethe rate that banks pay for overnight borrowing in the federal funds market.

9 Jul 2021 Fed research. In 2020 total Reserve Bank assets rose from 42 trillion to 74 trillion amidst the pandemic and related government lockdown and fiscal stimulus policies. Banking was conceived in iniquity and was born in sin.

The Federal Reserve is the Most Dangerous Enemy of the US. Repeat of the 2013 taper tantrum is a risk the Federal Open Market Committee will have to weigh up very carefully but not from a fear of sharply rising bond yields so much as the other moving. Top 10 Reasons to End the Federal Reserve.

So he wanted a completely decentralized system. It was the result of bad government. If the Federal Reserve had stepped in and bought government securities on a large scale and provided cash the depositors would have found they could have gotten their money and they would have stopped asking for it.

The author of Americas Bank a history of the Feds founding sat down with The Motley Fools Gaby Lapera and John Maxfield to cover the central banks history focusing in. The Federal Reserve Has Far Too Much Power to Control Our Economy. It was conceived in 1910 and constructed for.

According to Milton Friedman the Depression was caused by the government. 18 According to this view the Federal Reserve was incorrect in letting the rise in equity prices develop and should have raised interest rates to stem stock market speculation. The US Federal Reserve pledged to keep its low interest rate policies to help the USs continuing economic recovery.

The Federal Reserve System was the result of a series of financial panics most notably the Panic of 1907. Then more recently investors were increasingly anxious by a potential surge in price growth that could be tough to contain on the back of a buoyant economic recovery. Take it away from them but leave them the power to create deposits and with the flick of the pen they will create enough deposits to buy it back again.

Recession of 1981-82 Accessed Sept. Click here to see a PDF version of this report 1.

A Glossary Of The Federal Reserve S Full Arsenal Of Bazookas

11 Basic Things All Men Want From Women But Will Never Tell Inspirational Quotes Trent Shelton Quotes Quotes

Our Economy Begins With The Us Banking System Which Is Managed And Controlled By The Federal Reserve Description From Econsimu Federal Reserve Banking Economy

Stop Living Your Fears Inspirational Quotes Success Quotes Motivation

The Federal Reserve S So Called Taper Talk Could Keep Markets On Edge Through The Summer

The Federal Reserve Operation Within The U S Government Framework Download Scientific Diagram

/united-states-federal-reserve-building--washington-dc--usa-699686820-53430ccade8b462fb76c21e38a5b2371.jpg)

How Central Banks Affect Interest Rates

Fed S Barkin Says U S Has Made Substantial Further Progress On Inflation Goal Reuters

Fed Holds Rates Near Zero Here S What That Means For Your Wallet

You Would Like To Share This Interesting Purchsing Power Chart Purchasing Power Dollar Collapse Economy

Banking Panics Of 1931 33 Federal Reserve History

The Pandemic Has Ended The Myth Of Central Bank Independence

Federal Reserve To Unwind Its Emergency Purchases Of Us Corporate Bonds Financial Times

Federal Reserve System Updates News On The Fed Daily Mail Online

Federal Reserve System Updates News On The Fed Daily Mail Online

A Glossary Of The Federal Reserve S Full Arsenal Of Bazookas

/cloudfront-us-east-2.images.arcpublishing.com/reuters/RKULB6CKEVNRFIVIZ4S4MSN4ME.jpg)

Fed S Daly Says Could Get To Taper Threshold Late This Year Reuters

Central Bank Digital Currency Is The Next Major Financial Disruptor