Abdul Halim also called the announcement of this new system premature adding that PTPTN should provide a deduction schedule to employers that states when an employees deduction starts and ends. PGB is said to benefit borrowers in the lower income bracket and youths who have just entered the workforce.

Ptptn All You Need To Know About The Scheduled Salary Deduction Pgb Scheme News Rojak Daily

PTPTN scheduled salary deductions postponed.

Salary deduction schedule for ptptn. Salary deduction percentage by income tier. Finally theres the salary deduction methodUsing this method will help you avoid pesky tunggakan or arrears a debt that you need to pay back after you missed a single or few payments as PTPTN sets the amount to be deducted. This was also confirmed by the PTPTN chairman Datuk Dr Shamsul Anuar Nasarah recently.

As an example the repayment rate. The New PTPTN Repayment Scheme The government announced that the National Higher Education Fund PTPTN will implement the Scheduled Salary Deductions PGB beginning January 2019 to force-collect repayment of education loan owed by 29 million borrowers. As of August 2018 the 29 million borrowers owe the fund RM40 billion.

Assuming PTPTN goes ahead with this I can foresee several issues cropping up such as the employers facing problems when making the deductions since salary payments are computerised nowadays he said. The percentage of salary deduction depends on how much you earn. In a briefing today 5 December PTPTN chairman Wan Saiful Wan Jan revealed more details about how the scheduled salary deductions PGB mechanism will be implemented reported Free Malaysia Today.

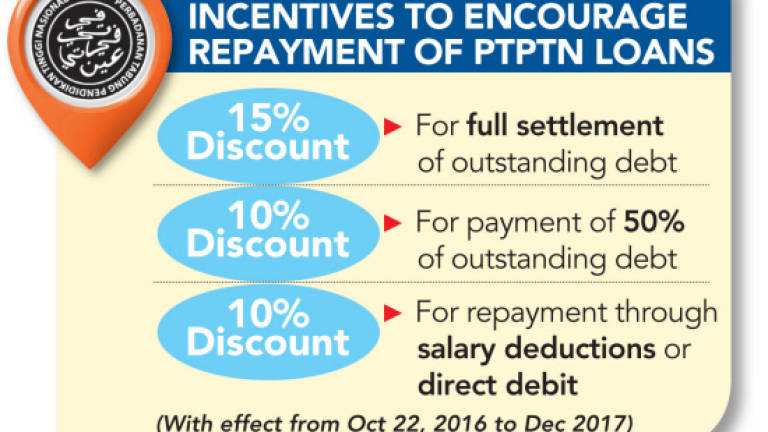

5 Perbadanan Tabung Pendidikan Tinggi Nasional Tingkat Bawah Menara PTPTN Blok D Megan Avenue II No. Salary Deduction Schedule for PTPTN Loan Repayment effective 2019 Under the new mechanism which was announced in Budget 2019 all PTPTN loan borrowers have to abide by the repayment of their student loan via salary deduction starting Jan 2019. During the Budget 2017 presentation last year Prime Minister Datuk Seri Najib Razak announced that borrowers are entitled to a 10 discount incentive if they make repayment through salary deduction or direct debit facility according to the repayment schedule.

Also known as Potongan Gaji Berkala the deduction percentage increases in tandem with the borrowers salaries. If this is the first time youre seeing it basically in late November 2018 the government announced that starting in 2019 they would start enforcing salary deduction to get more people to pay off their PTPTN loan. The salary deductions will increase progressively to 15 depending on the borrowers income and will apply to PTPTN borrowers earning RM1000 and above.

At the tabling of Budget 2019 Finance Minister Lim Guan Eng had announced the plan to deduct between two and 15 percent from the monthly income of. The decision to increase the minimum salary threshold and include the M40 to the exemption list are both seen as helpful for borrowers from low-income backgrounds. 12 Jalan Yap Kwan Seng 50450 Kuala Lumpur.

PTPTN has officially revealed details about the new mechanism for the PTPTN repayment scheme. Admin - 7th December 2018. The government has agreed on scheduled salary deductions for National Higher Education Fund Corporation PTPTN borrowers earning a monthly income of RM2000 and above instead of from RM1000 set earlier based on Budget 2019.

Based on the payment schedule submitted by PTPTN chairman Wan Saiful Wan Jan last Wednesday borrowers earning RM8000 a month should pay at least RM1200 a month equivalent to 15 percent of their. The National Higher Education Fund Corporations PTPTN move for employers to deduct their employee salaries for student loan repayments contravenes the spirit of the Personal Data Protection Act PDPA 2010. For them to announce it now before any agreement has been made between all the parties involved is rather premature.

Last week deputy education minister Teo Nie Ching announced in Parliament that those who have taken loans from the National Higher Education Fund Corporation PTPTN earning more than RM2000 will get between 2 and 15 per cent deductions from their salaries. Other things youll escape be free ofThe horrible situation of being blacklisted and having an undesirable credit score on CCRIS. According to the mechanism borrowers earning above the RM2000 threshold for mandatory salary deduction will see a percentage of their salaries automatically deducted.

But for PTPTN it has no analogous legislation and therefore must respect the Act in this instance.

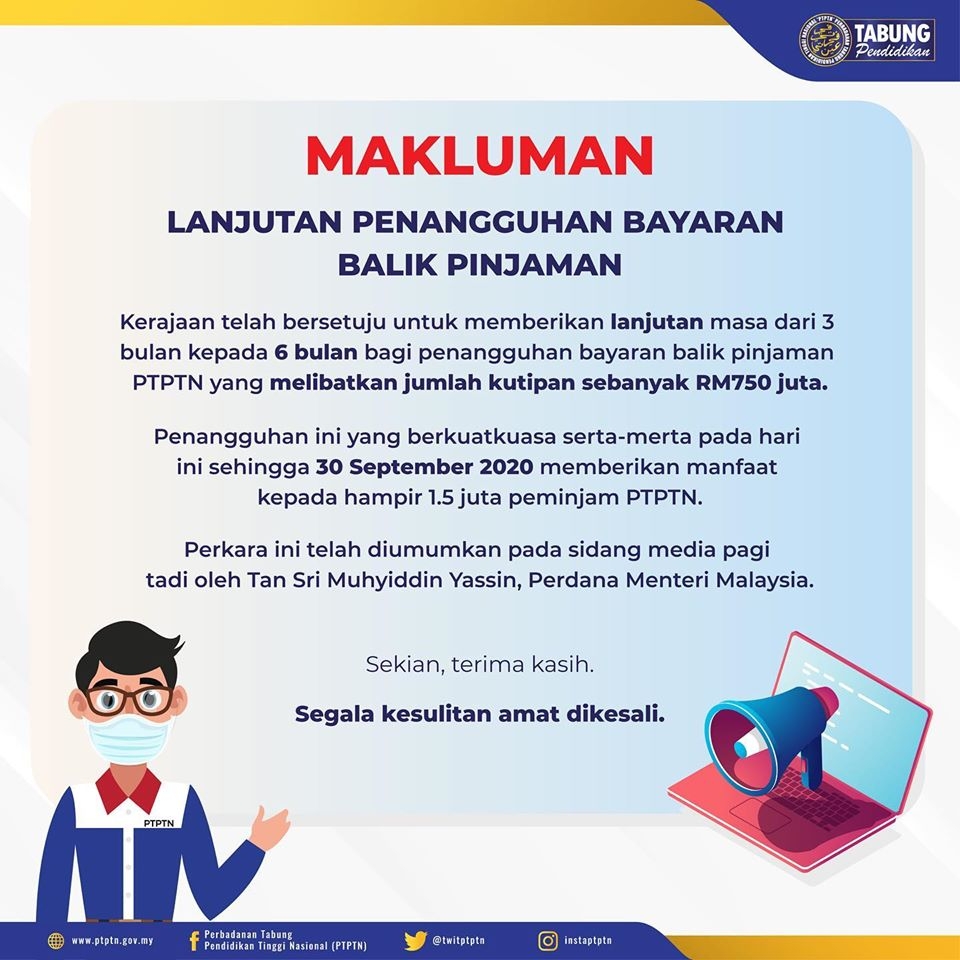

Ptptn Defers Loan Repayments Until December

A Guide To Repaying Your Ptptn Loan Eduadvisor

Discount Incentive For Ptptn Borrowers From Tomorrow Najib

Covid 19 Ptptn Loan Repayments Deferred By 6 Months

Your Guide To Ptptn Loan In Malaysia Eduadvisor

Finance Malaysia Blogspot Salary Deduction Schedule For Ptptn Loan Repayment Effective 2019

Re Inventing Ptptn Study Loan With Blockchain And Smart Contracts Han

10 15 Discount On Ptptn Education Loan Repayment Full Half Settlement Salary Deduction Direct Debit Until 31 December 2017

Ptptn Offers Online Facilities To Ensure Customer Convenience During Pandemic The Capital Post

Your Guide To Ptptn Loan In Malaysia Eduadvisor

Employers Receive Tax Exemption If They Help Employees Settle Ptptn Loan

422 609 Borrowers Resume Ptptn Loan Payment

What Happens If You Don T Pay Your Ptptn Loan Comparehero

Funding Your Education Ptptn 101

Is The 20 Discount Off Your Ptptn Loan Worth Taking Or Can You Do Better Things With Your Cash Sierralisse

Malaysiakini Com On Twitter Infographics New Ptptn Repayment Scheme Was Announced Yesterday With Scheduled Salary Deductions Beginning Next Year What Do You Think Tell Us More About It Read More On Https T Co E8d7tffx7m Https T Co Mu62ygtpzh