What if I dont have my debit card when I need to pay for commuter expenses. Theres no tax relief for breaking the law.

Are You Eligible For A Manhattan Resident Parking Tax Exemption

The proprietors sole-traders own parking costs are NOT tax-deductible as a business expense.

Parking charges return to pre tax. What document is used to report the amount of an employees pre-tax parking to the Internal Revenue Service. You cant claim tax back on parking or other fines incurred when youre driving. How is the pre-tax parking benefit computed in the personnelpayroll system.

Some pre-tax benefits may or may not be exempt from state and local taxes. For example without a tax a free parking space may be worth 1000 in pre- tax wages to an employee what the employee would need to earn in pre-tax wages to pay for the parking directly but with a 20 tax it becomes worth more than 1200. 01st Jul 2014 1537.

Steve are you saying. Round trip tolls are 5 and parking also costs 5 per day at the training location. Any parking or transit expenses that exceed the monthly amount loaded on the card must be paid for with personal funds.

Again tax relief only applies to these if they are business rather than private expenses. You cant deduct these expenses. There are different rules if you provide your employee.

Per IRS regulations you can use up to 265 per month pre-tax for qualified parking expenses such as those for park-and-ride and you can use up to 265 per month pre-tax for qualified transit expenses. The cost of reimbursing employees parking close to the office IS a tax-deductible expense for the sole-trader business whilst at the same time being non-taxable for the invidual employees but. Pre-tax parking is a way to to pay for your parking plan through payroll deductions.

If your Employer pays the parking garage for a parking space on your behalf you will not need to interact with TaxSaver Plan to receive the pre-tax benefit. This means that money will come out of your salary pre-tax and be returned to you in reimbursement for a direct expense AKA the cost or some portion of the cost of your parking. Use Publication 15 and Publication 15-B to find out which pre-tax benefits are exempt from each federal employment tax.

Remember you cannot deduct the parking fees you pay to park your car at your place of work. Personal deductions for car parking expenses. This should lower your effective income tax rate because you will be reporting lower wages.

The answer is based on an example of a GS-15 Step 5 in the 30 Tax Bracket and claiming 18000 a month for pre-tax parking. Some retirement plans such as a. Add what you pay for parking to their other earnings and deduct and pay Class 1 National Insurance but not PAYE tax Parking charges as earnings If you give your employee money to pay for parking.

Parking Charges Return to Pre-tax Deductions March 4 2020 The Tax Cut and Jobs Act of 2017 required the University to switch employee payroll deductions for parking charges from pre-tax to post-tax payments. This change occurred on April 1. A pre-determined amount will be deducted from your bi-weekly pay throughout the year instead of paying for the permit in full at the time of purchase.

With this your trips to the office go from nondeductible commutes to business mileagethe parking costs may also qualify for tax relief. Check your state and local laws to find out what benefit deductions are exempt from taxes. Short stay hourly andor partial day bookings are not available at this time.

It makes no difference whether the parking structure is owned by the local government or a private company. Common pre-tax deductions include. Some commuter benefits that help cover an employees transportation costs including public transit passes and parking fees are classified as pre-tax deductions.

It also makes no difference if the lot is attended or unattended. Car parking fees incurred in the course of producing assessable income are generally deductible but special rules apply if the car is used by an employee to commute between home and work or the car is. You are self-employed and rent office space a few miles from your home.

One potential way around this is to have a qualifying home office. Before 2018 you can deduct these expenses on your tax return. This is considered a nondeductible commuting expense.

Online parking charges are calculated on a per-day24 hour basis or part thereof. Parking fees for hourly parking in garages or parking lots are subject to sales tax. The office space charges a separate parking fee for the attached lot.

As an employer covering the cost of parking charges for your employees you have certain tax National Insurance and reporting obligations. If you park at an attended lot or garage the posted hourly charges may state that.

The Ultimate List Of Tax Deductions For Shop Owners In 2021 Tax Deductions Deduction Business Tax

Tax Return Tips Can Speed Refund Processing And Help Prevent Theft Of Your Refund Greenwich Free Press Tax Return Theft Prevention Tax

Pre Tax Parking Deduction Plan

Parking History And Receipts Paybyphone Support

Check Out All The Things Educators Can Deduct From Their Taxes Save Those Hard Earned Dollars Teache Teacher Tax Deductions First Year Teaching Teacher Info

How To Write A Tax Write Off Cheat Sheet Business Tax Tax Write Offs Small Business Organization

Profit And Loss Excel Sheet For Multi Level Business Multi Level Tax Accountants Multi Level Business Financial Statements Excel Sheet

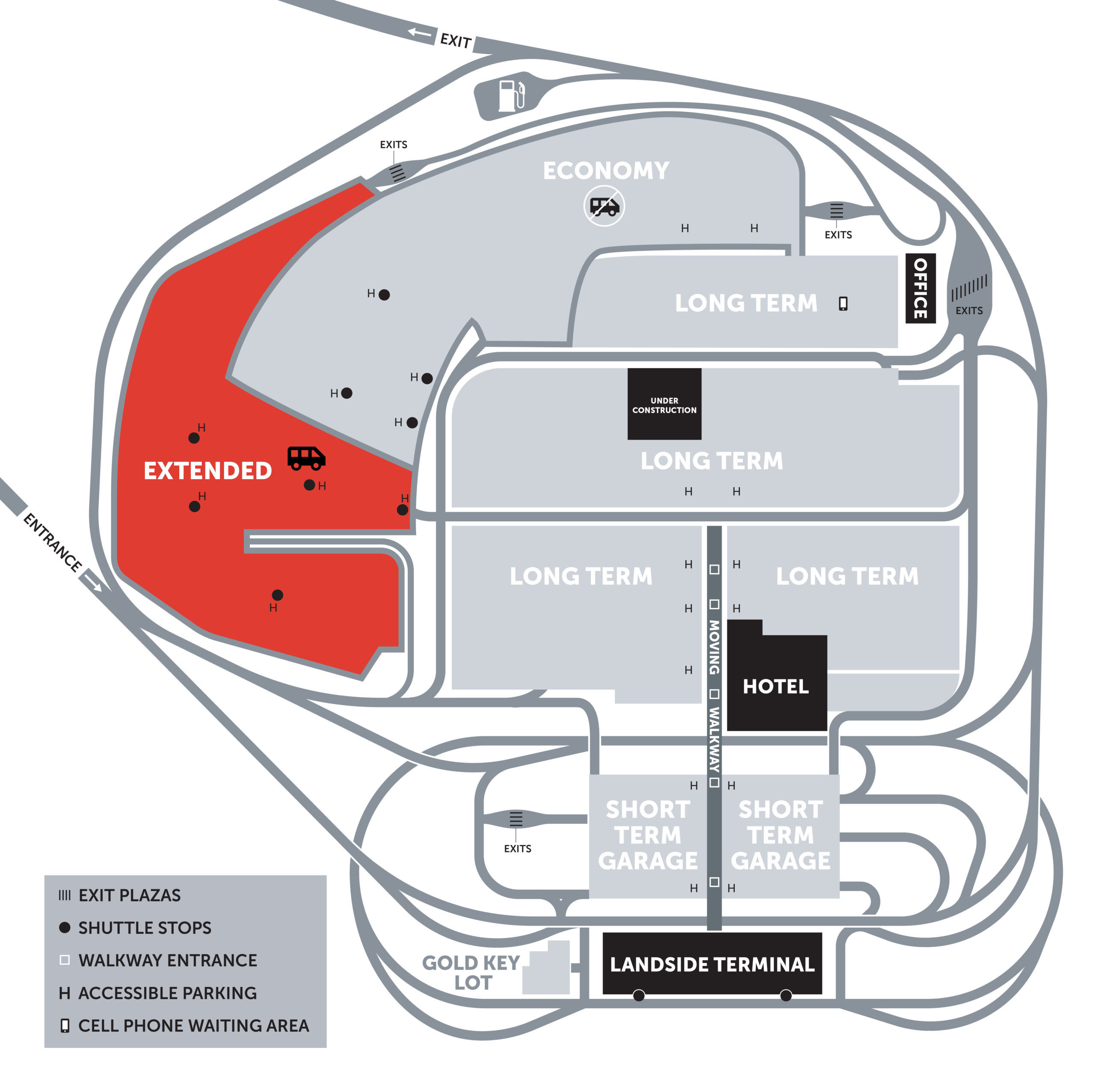

Parking Options Pittsburgh International Airport

Wrightsville Beach Increases Parking Rates Violation Fees Port City Daily

Pin By Bedford Travel Zone On Jta Travel London Travel Gatwick Travel

Parking History And Receipts Paybyphone Support

Standard Mileage Vs Actual Expenses Getting The Biggest Tax Deduction Turbotax Tax Tip Small Business Tax Deductions Business Tax Deductions Tax Deductions

Procedure For Filing Vat Returns In Dubai Uae Uae Return Dubai

Free Printable Budget Planners Budget Binder Fit Attitudes In 2021 Vacation Budget Planner Budget Vacation Travel Budget Worksheet

Contemporary Approaches To Parking Pricing A Primer 4 0 Employer And Developer Focused Parking Pricing Strategies Fhwa Office Of Operations

Parking City Of Mount Vernon Ny

How Pre Tax Commuter Benefits Work Commuter Benefit Solutions

Rental Income Property Analysis Excel Spreadsheet In 2021 Cash Flow Statement Statement Template Rental Property Investment