Sure there are huge differences between traditional and P2P investing. Also it is open to virtually anyone who is over 18 and has as little as Eur 10.

P2p Lending Vs Bonds Which Is The Better Investment P2pmarketdata

If your score is lower compared to what the banks consider acceptable then you will be locked out.

P2p investment what are differences. Prosper and Lending Club both allow investors to invest a minimum of 25 per note but Prosper gives a little more flexibility here. P2P lenders look into social and payment activities of a borrower while banks treat borrowers as merely another number on the credit report. Investing in P2P loans you make your money available to individual borrowers or small and medium-sized enterprises SMEs.

This article will provide you with an overview of three popular P2P investing platforms eg. So what are the key differences. Investors should therefore be aware that investing in P2P property loans might provide less cash flow compared to other types of debt-based crowdfunding.

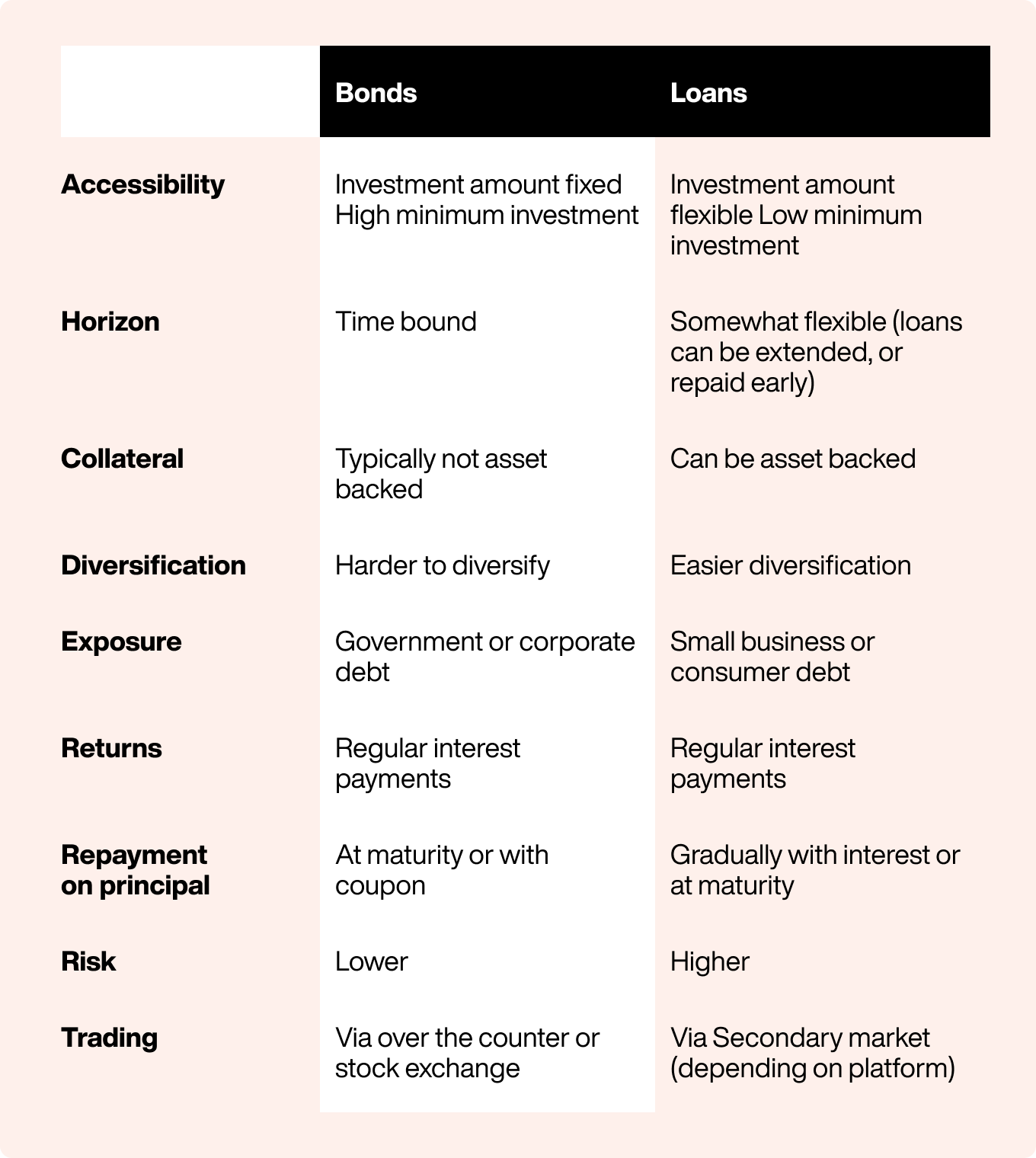

Rather than owning a stake in a business investors money is matched via an online platform to a loan for a person or business. P2P lending is most similar to investing in bonds. P2P lending is an alternative asset that offers attractive absolute and risk-adjusted returns even in todays low-interest-rate environment.

The significant difference between both finance solution is that peer to peer is loan-based and crowdfunding is equity-based. Peer-to-Peer Lenders are not Banks Peer-to-Peer P2P lending has become one of the most successful financial technology platforms in the world. On the other hand a positive aspect that might outweigh the low cash flow is the security of a property.

P2P Peer to Peer Investment Platforms. P2P lenders are creating lanes for consumers who typically have been shut out from accessing loans. Less paperwork and lower interests fast application.

Generally when it comes to peer to peer lending risks the higher the potential yield the higher the risk. Understanding Peer-to-Peer Lending P2P lending websites connect borrowers directly to investors. UK-based investment platform easyMoney explains differences between Innovative Finance Individual Savings Account and P2P lending options.

With its help startups can gain the necessary funds for growth in a short period without significant efforts. There are some key differences though such as. With Lending Club you must invest in multiples of 25 whereas Prosper allows any amount of at least 25.

Take for example the barriers to entry. Traditional investing is more like a closed club while P2P investing is democratizing access to financial freedom. Individual P2P P2P lending is a chance for investors to lend to businesses or individuals.

Its a specific amount of money repaid over a defined term and investors earn a return via interest payable on the loan. The loans generate income as interest for the lenders. P2P stands for Peer-to-Peer.

Mintos Twino and Bondora. The minimum needed to open an account with Prosper is 25. Peer-to-peer lending is a different model.

Like any investment offering higher than average returns there are substantial risks. A publicly traded partnership PTP is a type of limited partnership wherein limited partners shares are available to be freely traded on a securities exchange. Most importantly the interest is significantly higher than traditional banking investment productsbetween 10 to 50 times higher.

Also peer to peer loans often have a fixed rate but in some cases a target interest rate is given. Investing in peer-to-peer P2P lending is a great way to boost yields and diversify your portfolio significantly. P2P lending is a perfect alternative to investing.

A loan is very different to equity. Further to our first article Peer to Peer Lending within the new P2P section we will now draw our attention towards the various P2P investment platforms on the market. The difference is that if you fail to make the payments you could lose the collateral.

Given that some bonds are already giving negative yield you may consider some of the P2P loans with interest of 10 a bit like junk bonds given the much higher interest rate. P2P borrowers seek an alternative to traditional banks or a better rate than banks offer. Investing in bonds you are lending your money to governments or usually large companies.

Below are some of the differences between the p2p lending model and traditional banks. P2P lending has some advantages. P2P P2P P2P Instead of asking banks for loans P2P cuts out the bank and websites like Crowdstacker connect lenders and borrowers.

Mutual Funds And Index Funds Are Two Popular Investment Vehicle Types Recognized By Their Key Features Of Offering Convenie Mutuals Funds Index Funds Investing

P2p Lending Vs Stock Market Investing What S Best For You

What S The Difference Between Bonds And P2p Loans Visual Ly

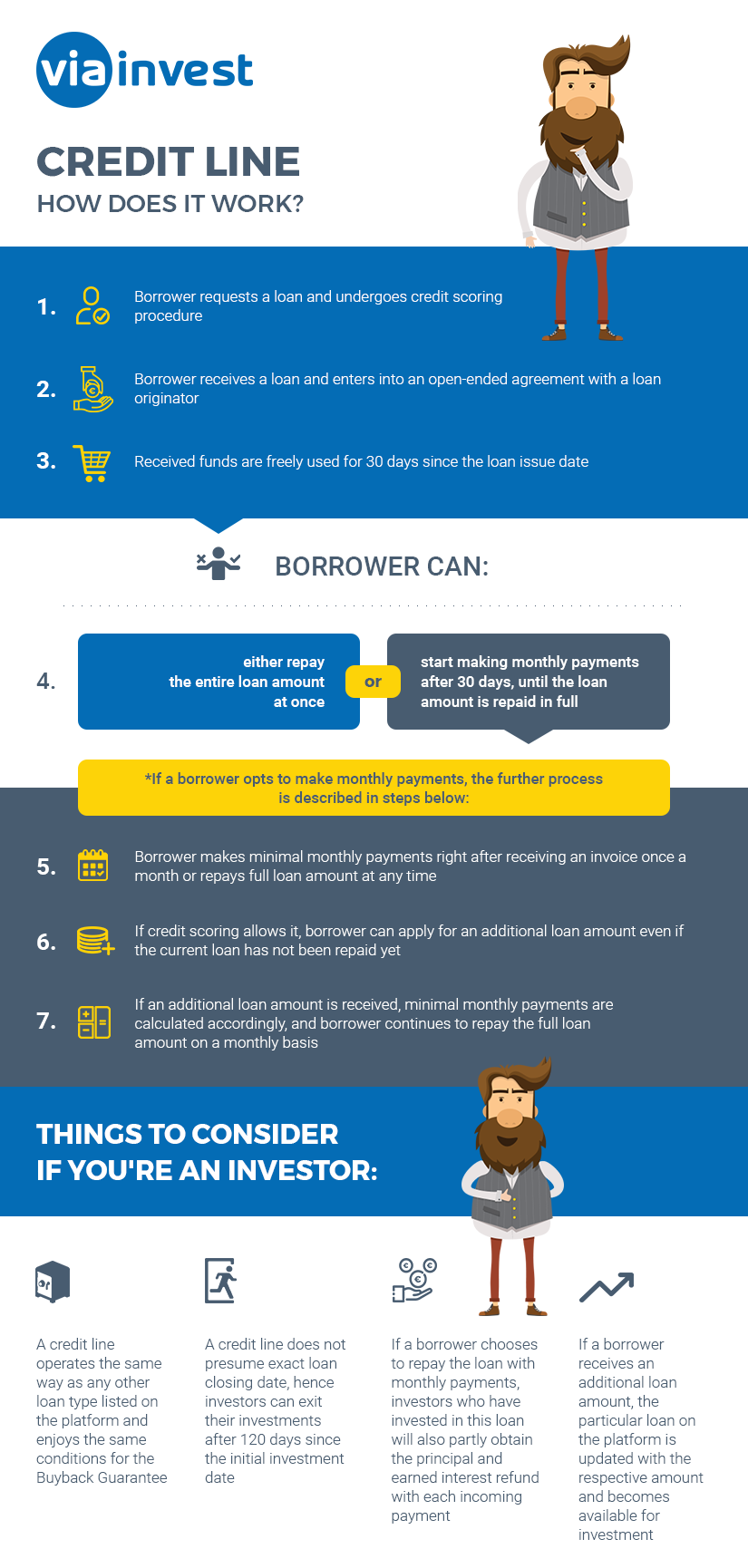

Investing In Loans A New Generation Of Asset Class Mintos Blog

Cryptocurrency Investing Vs Trading What S The Difference Cryptocurrency Investing Investing Cryptocurrency

What Is Peer To Peer P2p Lending Peer To Peer Lending Investing Money Smart Money

Pin On Crypto Investing Infographics

P2p Lenders Be Aware The Two P2p Lending Business Models

P2p Lending Vs Stocks What Should You Choose P2pmarketdata

Are You Frustrated Investing In Bonds Check Out Peer To Peer Lending As An Investment From An Expert Following T Peer To Peer Lending Peer Accredited Investor

P2p Lending Explained Business Models Definitions Statistics

Crowdfunding Industry Statistics 2015 2016 Crowdexpert Com Equity Crowdfunding Crowdfunding Investing

We Evaluate Each Borrower On Multiple Parameters Which Include Screening Of Personal Financial And Professional Details Peer To Peer Lending Money Lender Peer

Investing Vs Spending Mindset Differences Episode 67 Worth It Podcast What S The Difference Between Investing A Investing How To Be Outgoing Mindset

What Is P2p Lending And How It Works The Ultimate Guide

Pin On Crypto Investing Infographics