AirAsias Philippine unit has deferred its US250mil IPO. Hassan Basma ceo of Bumi Armada said the company aimed to increase its world ranking in the segment from eight to four.

Nestcon Offering 161m New Shares Under Ipo Mulasaham Com

UPDATE 1-Malaysias Bumi Armada IPO to raise 906 mln.

New ipo bumi armada. It expects to raise gross proceeds of about RM195bn from the flotation. AirAsia Bhd IOI Properties Group Bhd Bumi Armada Bhd and Chemical Company of Malaysia Bhd CCM are among the stocks to watch on Wednesday according to JF Apex Research. Bumi Armadas IPO which will be one of the largest announced in Southeast Asia this year was delayed several times in the past few years.

Bumi Armada Bumi Armada Bhd BAB is seeking a listing on 21st July 2011 with an enlarged share capital of 293bn shares of RM020 each on the Main Market of Bursa Malaysia. It is reported that OLDTOWN IPO price fixed at RM125 per share. UOA IPO listing date 8 June 2011 exit time.

It expects to raise gross proceeds of about RM195bn from the flotation. Based on the retail IPO price of RM303 per share BAB will have a market capitalization of RM887bn. Bumi Armada Bumi Armada Bhd BAB is seeking a listing on 21st July 2011 with an enlarged share capital of 293bn shares of RM020 each on the Main Market of Bursa Malaysia.

Bumi Armada specialises is an offshore support specialist and is the only Malaysian company that owns floating production storage and offloading FPSO vessels which carry a premium lease rate. Research houses like MIDF and OSK have pegged their fair value at RM362 and RM365 respectively. The IPO will comprise the offering of up to 878539 million existing at around RM315 a share and new ordinary shares of RM020 each in the company that would immediately value the firm at over RM7 billion.

The company is still. 3 Min Read IPO amount bit lower than initial 1 billion expectations IPO. Bumi Armada provides offshore services through four business units and two support units.

Based on the retail IPO price of RM303 per share BAB will have a market capitalization of RM887bn. Some 38 of the proceeds will be used. Based on the retail IPO price of RM303 per share BAB will have a market capitalization of RM887bn.

The retail offering of 79861400 issue shares to the malaysian public the directors of bumi armada and eligible employees and persons who have contributed to the success of bumi armada and its subsidiaries at the retail price of rm315 per share retail price payable in full upon application and subject to a refund of the difference in the event that the final retail price is less. Bumi Armada Bumi Armada Bhd BAB is seeking a listing on 21st July 2011 with an enlarged share capital of 293bn shares of RM020 each on the Main Market of Bursa Malaysia. Based on the retail IPO price of RM303 per share BAB will have a market capitalization of RM887bn.

Bumi Armada set its initial public offer IPO price at RM303 some 4 per cent below its indicative price at the launch of the IPO. The main business units are FPSO Offshore Support Vessels OSV Transport Installation. The Initial Public Offering IPO consists of 8785 million ordinary shares at an IPO price of RM315 per share at RM020 par value.

Ananda Krishnan and a planned relisting in 2008 was delayed due to the global financial crisis. The company was privatised in 2003 by tycoon T. Bumi Armada Bumi Armada Bhd BAB is seeking a listing on 21st July 2011 with an enlarged share capital of 293bn shares of RM020 each on the Main Market of Bursa Malaysia.

By 8 June you will be able to exit your UOA investment by selling it at the market to spare cash for the upcoming exciting IPO OLDTOWN and mega IPO Bumi Armada. Bumi Armada is set to list on Bursa Malaysia to fund expansion of its floating production storage offshore FPSO fleet. Bumi Armada said it plans to sell 8786 million shares of which 6443 million are new shares and the rest are existing shares held by its present shareholders through the IPO.

Bumi Armadas IPO which will be one of the largest announced in Southeast Asia this year was delayed several times in the past few years. It expects to raise gross proceeds of about RM195bn from the flotation. Published on Sep 12 2018.

Sources say it is a. AirAsia IOI Properties Bumi Armada CCM. A subsequent relisting plan was also shelved.

Some 38 of the proceeds will be used. However Bumi Armada IPO price remains unknown. Malaysias largest owner and operator of offshore vessels Bumi Armada is planning a 700m to 800m initial public offering IPO.

We think this valuation is fair given the groups sheer size as well as its capability in providing one-stop solutions starting from oil and gas exploration up to. Bumi Armada Bhd has appointed former chief executive officer of the Employees Provident Fund EPF Tunku Alizakri Raja Muhammad Alias pic. Get by Email RSS.

Bumi Armada IPO News Monitoring. Some 38 of the proceeds will be used. Offshore oil and gas service provider Bumi Armada Bhd plans to raise about RM28bil from its initial public offer IPO that will see the sale of 87854 million existing and new.

Bumi Armada Bhd a leading international offshore oil field services contractor is schedule to be listed in Main Market on 21st July 2011. Bumi Armada is a Malaysia-based international offshore energy facilities and services provider with a presence in over 10 countries spread across three continents supported by. Former EPF CEO on Bumi Armadas board.

Malaysian oil and gas services provider Bumi Armada plans to raise nearly 1 billion from its initial public offer. Some 38 of the proceeds will. It expects to raise gross proceeds of about RM195bn from the flotation.

Bumi Armanda Wins 740 Million Fpso Charter Contract From Ongc

Online Legal Services Firm Legalzoom Jumps 31pc In Debut Valued At Us 7b Money Malay Mail

Livingsocial Seeks 1 Billion Ipo Wsj

Ringgit Insider Bumi Armada Ipo Vs Hibiscus Petroleum Ipo

Livingsocial Seeks 1 Billion Ipo Wsj

News Press Releases Bumi Armada Berhad

Ctos Seeks Main Market Listing Ipo To Offer 1 1 Bil Shares Mulasaham Com

Roblox Ipo Filing Shows Revenue Surge As Gaming Thrives During Pandemic Money Malay Mail

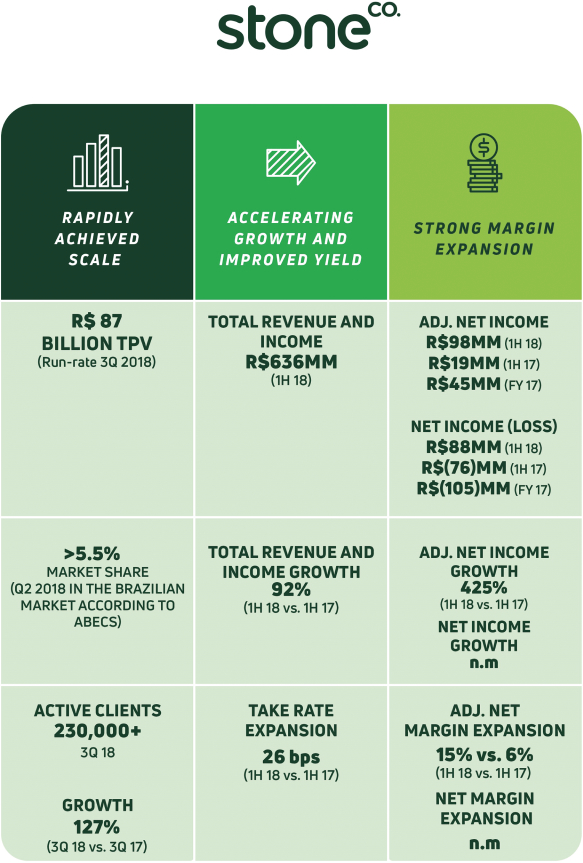

Stoneco Ipo How I Use Business Sense To Understand Why Berkshire Finally Bought Into An Ipo Investing Theory 2 Ipo Valuation I3investor

Kanzhun Limited Announces Pricing Of Initial Public Offering Opera News

Offshore Support Journal March April 2011 By Rivieramaritimemedia Issuu

New Mega Ipo Bumi Armada Berhad Date Price Tax Updates Budget Business News

Stoneco Ipo How I Use Business Sense To Understand Why Berkshire Finally Bought Into An Ipo Investing Theory 2 Ipo Valuation I3investor

Knots Ahead Of The Rest Bumi Armada

The Black Scholes Formula Explained Finance Tracker Implied Volatility Partial Differential Equation